The rise of artificial intelligence (AI) is reshaping industries across the globe and as AI technology continues to advance more investors are turning to AI stocks to capitalize on the growth of this transformative field.

AI stocks are shares of companies that are heavily involved in the development implementation or use of artificial intelligence technologies.

With AI applications expanding across sectors like healthcare finance and manufacturing AI stocks present exciting opportunities for investors looking to tap into this burgeoning market.

What Are AI Stocks?

AI stocks refer to the stock of companies that leverage artificial intelligence to develop products services or solutions.

These companies are often at the forefront of AI research and development working on everything from machine learning algorithms to autonomous systems and natural language processing technologies.

From software companies developing AI based applications to hardware manufacturers producing AI powered chips the scope of AI stocks is vast.

Why Are AI Stocks Becoming So Popular?

- Innovation and Growth Potential

AI has the potential to revolutionize many aspects of our lives, from automating mundane tasks to solving complex problems. The rapid pace of AI innovation means that companies engaged in this field are constantly creating new products and services, driving growth. For investors AI stocks represent a chance to participate in this exciting frontier of technological advancement. - Widespread Adoption Across Industries

AI is no longer confined to tech companies its applications are expanding to industries such as healthcare automotive, finance logistics, and even entertainment. Companies that adopt AI can achieve greater efficiencies improve customer experiences and unlock new revenue streams. This widespread adoption makes AI stocks particularly attractive to investors looking for diverse opportunities. - Significant Market Size

According to several reports, the global AI market is expected to grow at a compound annual growth rate (CAGR) of over 40% in the coming years. As AI becomes more integrated into products and services, the market for AI solutions will continue to expand, leading to more potential growth for AI stocks. - Long-Term Investment Appeal

AI is considered a long term investment opportunity as it is expected to drive major technological advancements for decades to come. For investors who are looking for stocks with the potential to deliver substantial returns over time, AI stocks are an attractive option.

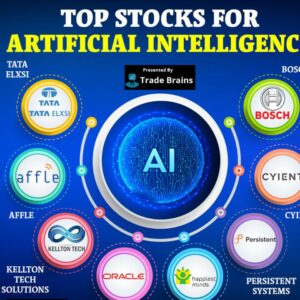

Key Companies Leading the AI Stocks Movement

Several companies are at the forefront of the AI revolution, and their stocks are some of the most widely followed by investors interested in artificial intelligence.

- NVIDIA (NVDA)

NVIDIA is a leader in the development of graphics processing units (GPUs) that power AI applications. - Alphabet (GOOGL)

Alphabet, the parent company of Google, has been investing heavily in AI research and development. Google AI initiatives include advancements in natural language processing machine learning, and AI driven advertising technologies. As AI becomes more ingrained in Google operations Alphabet remains a key player in the AI stock space. - Microsoft (MSFT)

Microsoft is another technology giant making significant strides in AI development. With products like Microsoft Azure which offers AI powered cloud services and advancements in AI research through its acquisition of companies like Open AI Microsoft is positioning itself as a leader in AI technologies. Its stock continues to benefit from the increasing adoption of AI across industries. - Amazon (AMZN)

Amazon has long been a major player in e commerce but it is also at the cutting edge of AI development. The company diverse business model and AI-driven solutions make its stock a solid pick for AI focused investors.

AI Stock

Also Read: Nora Fatehi Deepfake

How to Invest in AI Stocks?

Investing in AI stocks can be both exciting and overwhelming, given the variety of companies and industries involved in AI. Here are a few tips for investors looking to get started:

- Research and Understand the Technology

Before investing in AI stocks it’s crucial to have a solid understanding of how AI works and which industries are being disrupted by its applications. - Diversify Your Investments

While AI is a rapidly growing field, not all AI stocks will perform equally well. To mitigate risk, consider diversifying your investments across multiple AI companies and sectors. This can help balance out any underperforming stocks with others that may see significant growth. - Look for Long-Term Growth

AI is a technology that is likely to see significant growth over the long term. When evaluating AI stocks, look for companies with strong fundamentals robust research and development initiatives and a commitment to integrating AI into their business models. This can help ensure that you’re investing in stocks with staying power. - Consider AI ETFs

For those who prefer a more hands-off approach to investing, AI exchange-traded funds (ETFs) can be an attractive option. These funds pool investments in a variety of AI stock providing exposure to the broader AI market. This can be an excellent way to gain diversified exposure to AI without having to pick individual stocks. - Stay Updated on Industry Trends

The AI landscape is evolving rapidly with new developments and breakthroughs happening regularly. By staying informed about industry trends regulatory changes and emerging technologies you can make better investment decisions when it comes to AI stocks.

Risks and Considerations for AI Stocks

While AI stock offer significant growth potential, they are not without risks. Here are a few key considerations before diving into AI investing:

- Volatility

The technology sector, including AI stocks, is often highly volatile. Prices can fluctuate based on factors like market sentiment technological breakthroughs or regulatory changes. Investors should be prepared for some level of volatility when investing in AI stock. - Regulation and Ethical Concerns

As AI technologies become more widespread, there is growing concern over privacy, data security, and the ethical implications of AI. Governments and regulatory bodies may impose new regulations that could impact AI companies making it important for investors to stay informed about potential changes in the regulatory environment. - Competition

The AI space is highly competitive, with many companies vying for market share. While this competition can drive innovation it also means that not all companies will succeed. Investors should be cautious and do their due diligence to avoid investing in companies that may struggle to maintain their position in the market.

Final Thoughts Of AI Stocks

AI stocks present a compelling opportunity for investors looking to capitalize on one of the most transformative technologies of the modern era.

With widespread adoption across industries and the potential for long term growth the AI sector offers diverse investment opportunities.

By understanding the technology staying informed about industry trends and carefully selecting AI stock investors can position themselves to benefit from the rapid growth of artificial intelligence.

As AI continues to evolve, the future of AI stock looks incredibly promising. Whether you are an experienced investor or a newcomer to the world of technology stock AI stock provide a unique chance to invest in the future of innovation.

So keep a close eye on this exciting sector and consider adding AI stock to your investment portfolio for long term growth.